A company’s accounting and financial reporting are in every way the backbone of a company. This department is responsible for managing and maintaining complete financial and transaction records.

The methods used by accountants in the past have indeed been successful. Still, the growing demand for quick access to financial records with 100% accuracy has left accountants struggling with traditional methods.

Technology has advanced rapidly, and all companies are simplifying its use in one way or another. New accounting challenges are best solved with new accounting solutions; H. uses the latest accounting software.

Sometimes software works with VPN and when speaking about the VPN we got the best solution for you to have a look at privacyenbescherming.

For accountants dealing with multiple transactions daily, the latest accounting software only meets the need for error-free and acceptable accounting practices.

How does accounting software support business growth?

Any software or program that will help you automate your company’s processes and speed up the time you spend doing your day-to-day tasks is an excellent tool for increasing productivity. If you are currently struggling with your company’s bookkeeping, accounting software can be beneficial.

Accounting software often integrates tools for clearing transaction data, payments and creating financial reports. Some offer versions for mobile devices so that you can always enter new data.

Security Software?

Security software is one that is designed to protect computers against any risk. Computer dangers cover a wide variety of attacks, from viruses or malware, to data loss or illegitimate access. Have a look on the security software securicritic

Advantages Of Accounting Software Over Excel

You may think that your company doesn’t need to move to an automated accounting system because it is small, but the faster you transition, the easier the process becomes. These are some of the reasons Tech Suppor Reviews believe accounting software is better than Excel.

1. Centralize the process

It may seem more straightforward to use Excel since, in most cases, it is a program that you already have available. The records you create in Excel are less stable than those you could make in an accounting program.

Every time you submit or approve an accounting file created in Excel, you are putting at risk the information that other people may add after receiving it. You risk losing valuable data if third-party changes are not reflected in the central database. In addition, they make dumping the data more difficult, as they have to check all available file versions to ensure that all external information is registered.

Using an accounting program means you don’t have to worry about comparing information from multiple versions. The central database is available to everyone and is the only place the data is flushed.

2. Increase process reliability

Not only is it challenging to collect information about any changes that can be made in the documents that capture the accounting movements, but there is also the possibility that there are people making changes to commit fraud; As a result, it becomes more challenging to keep track of all the changes and movements that have been created. This is unlikely to happen if you are using accounting software as all of your information is stored in one place, and from there, you can also monitor any changes in detail.

3. Optimize the accounting and tax processes.

The process in a spreadsheet can be much more complex, regardless of whether an accountant or a colleague from your company with special training is doing the bookkeeping. Requires the configuration of performance verification formulas and processes to achieve good performance.

With the use of software, you will find that the tasks of the team or the accountant are streamlined to work better. In addition, the handling of the tax tasks that your company has to submit is made more accessible by optimizing the entire accounting process.

4. Facilitates adaptation to unforeseen changes

Imagine having to add new bookings to billing dates for the month two days before filing a statement. It turns out that it is not possible because you will need to create another formula first for the information you downloaded to be processed correctly. While this last-minute change is possible, it will likely put pressure on whoever is responsible for bookkeeping.

With accounting software, accurate results are much easier than with an Excel spreadsheet because it is more intuitive. Therefore, any adjustment can be made faster and more efficiently.

5. Simplify the financial reporting process.

Many accounting programs offer a financial reporting service, and ultimately, this is a feature you will never get from Excel. While no report is infallible, this type of document is beneficial for comparing or complementing the analysis carried out by those in charge of your company’s finance department.

6. Increase the development of your company

If you are a small business owner, you are unlikely to face complicated calculations or excessive amounts of sales and purchases. However, suppose you are the owner of a midsize business that is on the way to getting significant and consolidated. In that case, you may face an amount of information that is no longer manageable, even for a specialized accounting team.

Although the problem could be solved by expanding the responsible team, accounting software that would make the amount of information more manageable could also be implemented.

7. Reduce the chance of mistakes.

Hand in hand with the previous point, doing the calculations manually (even by a professional accountant) results in more errors than using accounting software.

While it may seem that clearing information is accessible, the truth is that being a repetitive activity also involves a degree of difficulty that can lead to errors. Over time, the accumulation of downtime can seriously damage your business. By entrusting the most repetitive processes to software, the people in charge can better focus on the tasks that require complex procedures.

That is why you must know what the market offers and choose the best solution for your needs.

To make the process easier, Tech Support Reviews have listed the best accounting software you can find below:

Wave

It is accounting software that offers plans for high-level business users, but it has all the solutions for micro, small or medium business needs in the free version. You can link as many bank accounts and credit cards as you want, and the number of employees is unlimited.

Provides billing and receipt scanning tools – scanned receipts are automatically entered into accounting transactions. It also gives you the possibility of installing a mobile application (Android and iOS) so that you can enter and consult your information from wherever you want.

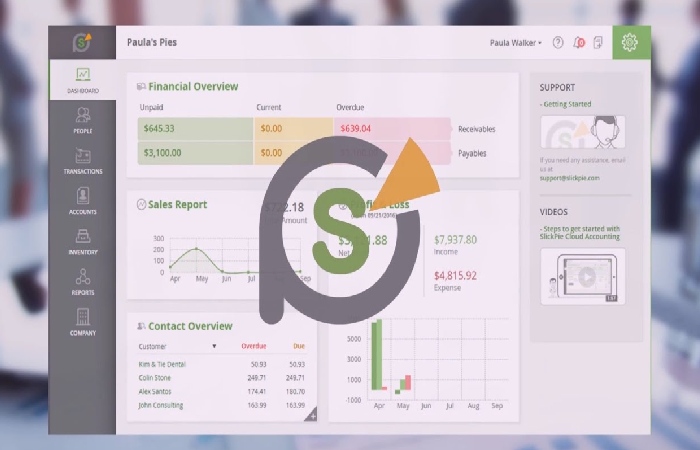

SlickPie

Suppose you want to automate your accounting processes. In that case, SlickPie is the solution for you, as you can create recurring invoices automatically and use the pre-installed MagicBot app to add receipts and accounts to the ledger.

With it, you can also accept payments with PayPal, Stripe, and credit cards, add an unlimited number of users, create financial reports and manage your invoices and accounts. It is only available in a web version.

Nubox

Nubox is a software service company that offers a cloud service. Small and medium-sized businesses can manage their businesses 100% online and have all of their accounting and administrative information in one place, constantly updated.

Nubox has three business-focused products: billing and collections, compensation, and accounting. In this way, you can generate sales documents, collect and maintain a complete accounting record of all movements.

In addition, with the remuneration product, you can manage your teams remotely, developing salary settlements, automating payments, and keeping the payroll updated. All in a simple and automated way so that entrepreneurs save time typing and focus on growing their company. It also integrates with the HubSpot CRM, where you can view your invoices without leaving HubSpot.

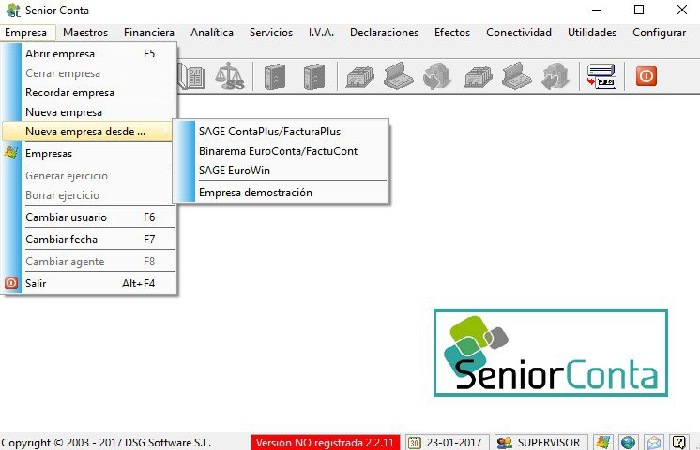

Senior Conta

Senior Conta is free accounting software with which you can manage all the operations and records you need if you are the owner of a micro, small or medium-sized business.

It’s a solution that allows you to have multiple users, does not limit the amount of information you can access, and offers functions to generate reports, statistics, and diagnoses that minimize all the accounting irregularities that your business could have.

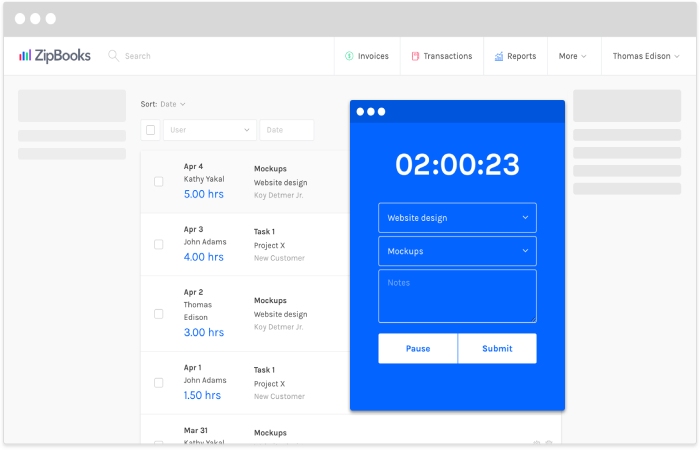

ZipBooks

This platform offers a free plan called ZipBooks Starter. The advantage is that you will have the possibility to upgrade to any of its paid versions, with more features, whenever you need it; for example, when your business starts to expand and you will require more features or capabilities.

It is available for any internet browser and also for iOS. Includes unlimited billing and registrations; you can also pay by credit card or PayPal. The downside is that you can only link one bank account to the app.

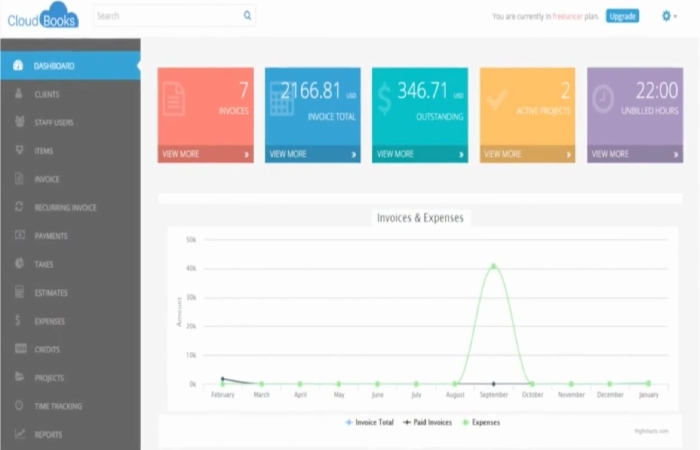

CloudBooks

One of the most notable features of CloudBooks is the time tracking function and project customization. It will allow you to see where your employees are spending their time in each of the projects that you have active and track them accurately.

CloudBooks only allows you to have one user per account in its free version, so if you need to expand the number of users, you’d better pay for one of their plans.

If you need assistance, the free version offers you support through their team via email (available 24/7); the paid versions also give you support by chat and phone.

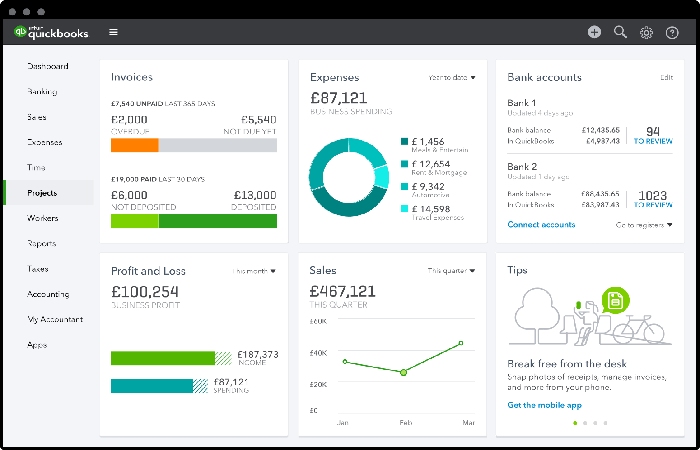

Intuit Quickbooks

Its version allows you to capture receipt information, track income and expenses, send invoices, and accept payments.

You can also integrate its functions with popular applications such as Square, Paypal, or Shopify, and track inventory, projects, time, and even manage up to 1,099 contractors with the advanced edition of the software that you have available for Android and iOS.

Freshbooks

Freshbooks gives you an outstanding user experience due to its intuitive and precise design. It is the software you need if you are looking for a tool to send invoices periodically, track times, or manage collaborations on projects with colleagues.

One downside to Freshbooks is that it lacks inventory tracking. Either way, it integrates with multiple applications and platforms such as G Suite, Zapier, or Stripe; with this, you will be able to keep all your management tools connected.

Control

This is an alternative for software available in the cloud and a local version on a computer.

The interface is easy to use and makes data dump easy; it offers the export function to PDF and all Office formats. You can also automate specific processes and create templates and predetermined concepts to optimize the working times of those in charge of these matters in your company.

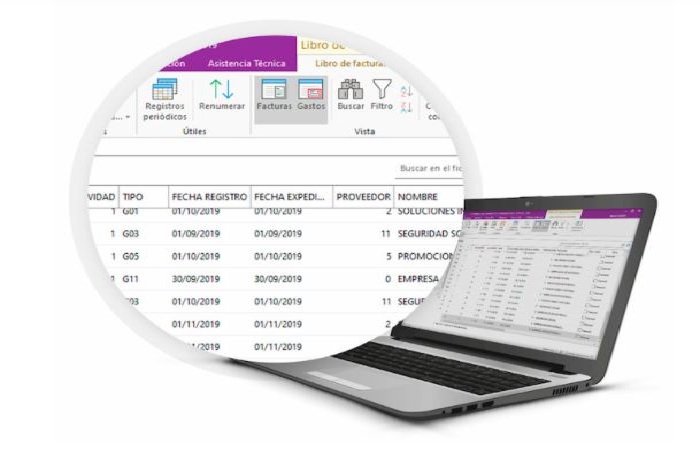

a3ERP Accounting

This is a complete solution for your business accounting. With it, you will be able to invoice, manage payroll, and carry out analysis and budgets from the same place without worrying about duplicating data or generating additional payments.

Sage 50cloud

Sage 50cloud offers you an inventory of tools for management and payment schemes of 10 different levels. You can pay bills and manage your clients’

payments; You can also access your information from anywhere and anytime since its platform supports all information in the cloud.

It offers you one of the most efficient accounting and business management suites on the market.

You have it available for iOS and Android systems, in addition to the online version that you can access from any internet browser.

GnuCash

If you are looking to track stocks, bank accounts movements, income, expenses and balance your records in general, GnuCash is the solution you need. Its main features include a tool to generate financial reports, payroll for your employees, and a vendor and customer tracker.

It does not include live customer service, but it does have a mailing list that you can contact to request support. There are also manuals, tutorials, and guides to help you master the software (available in English).

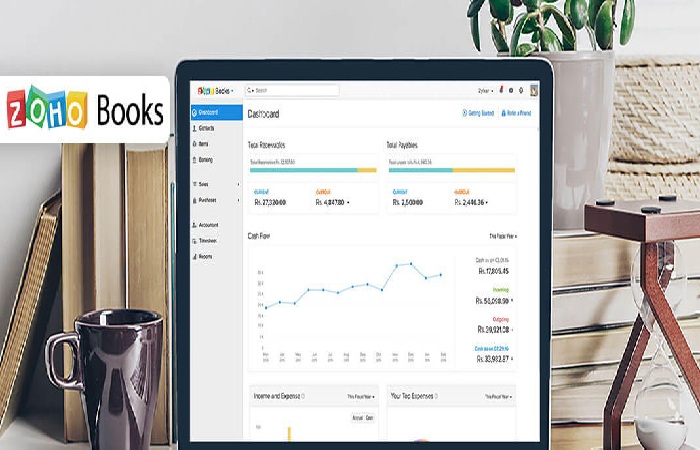

Zoho Books

Zoho Books is accounting software with a well-designed and easy-to-use interface. You can use it to keep track of projects, manage time, schedule recurring transactions, and make invoices and documents.

Its automation tool will free you from repetitive tasks. You have editions available for Android and iOS, in addition to the platform that works from any internet browser.

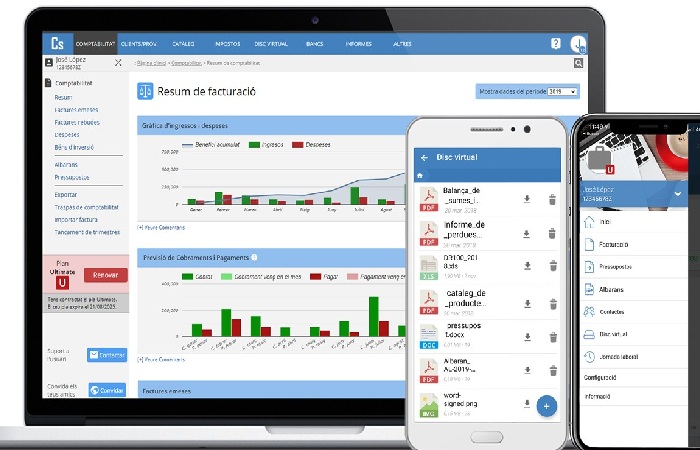

Contasimple

It is a cloud software available for mobile devices (both Android and iOS). Its design is excellent and intuitive, so you won’t have to worry about learning how to use it.

Available functions include using templates for invoicing, customization, expense management, and creating books for accounting records. You can also make budgets.

Xero

Xero’s core features include customizable reporting, inventory tracking, online snippet appointments, and payroll processing for your employees. You can integrate Xero services with more than 700 points of sale tools, CRM, and more, available in their desktop version and for iOS and Android.

Other functions include easy linking to your bank account to quickly capture and report all transactions.

AccountEdge

AccountEdge is a desktop solution that you can use to register and accept payments from credit cards. One of the disadvantages is that your cloud storage services are obtained by paying an extra cost. Despite this, you can access the free versions for mobile devices (iPhone and iPad) if you need to use the accounting tools elsewhere.

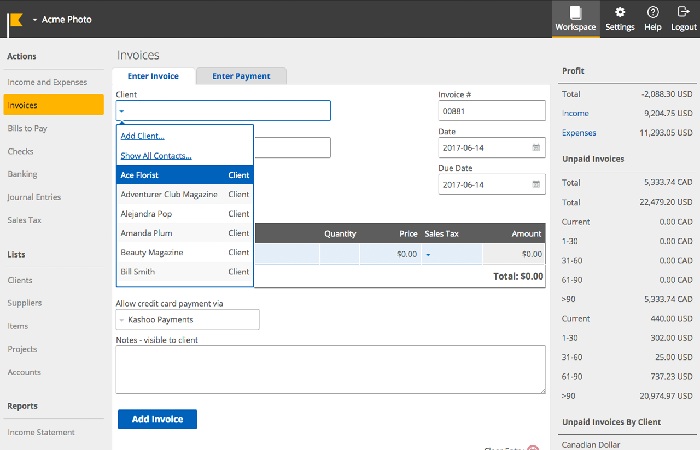

Kashoo

Kashoo can be the solution if you need a simple software to carry out your accounting activities and are an adept user of iOS. You can link multiple bank accounts, create financial statements, and accept credit card payments. It also handles various currencies, so you won’t have to worry about exchange rates between currencies.

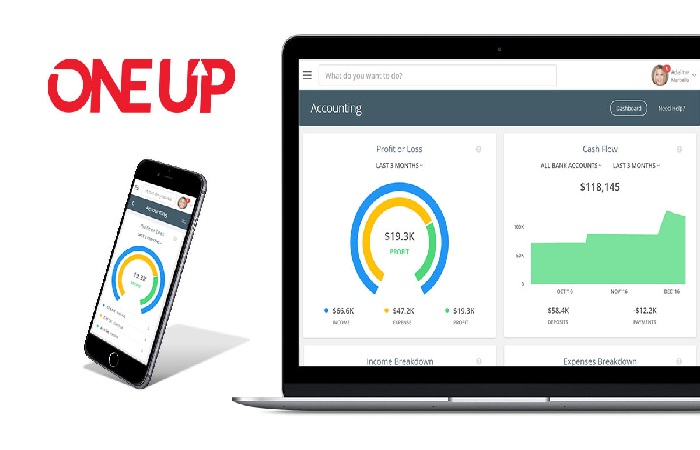

OneUp

OneUp is an excellent alternative if you are looking for a complete tool for managing your inventory. You can sync your bank account to report transactions and record expenses. OneUp relates bank transactions to existing invoices and accounts and can create a new record if it cannot find the document with which to link the operation; thus, the registration will undoubtedly be sped up.

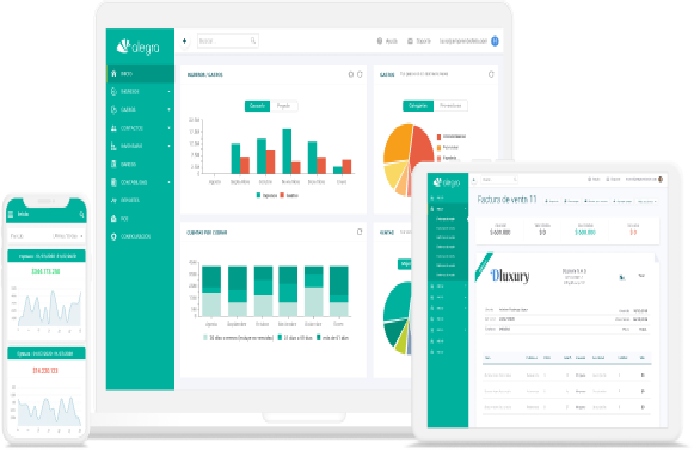

Glad

Alegra is a cloud application for the administration and accounting of SMEs that allows electronic invoicing, electronic payroll, expenses, banks, inventories, generating an online sales catalog, and having intelligent reports of all the information entered.

It started operations in 2013, since then it has had exponential growth, and today it has 500,000 registered companies and has optimized versions for 13 countries (Panama, Peru, Chile, Mexico, Dominican Republic, Spain, Costa Rica, United States, Argentina, Nigeria, Kenya, South Africa, and Colombia). Currently provides the following services:

- Accounting and Administrative Software.

- POS software for point of sale.

- Virtual store

- Issuance of electronic tax documents ( electronic invoicing and electronic payroll).

Investing in software that helps you with accounting operations will save you a lot of time and minimize management hassles for your company: it will free you from carrying out manual records and operations.

Conclusion

The accounting software mentioned above is the top accounting software for medium and large businesses. Not only does this software help streamline accounting processes, but it also enables business owners to focus more on labor productivity and business growth.

The features vary widely and depend on your business needs; you have to choose the best that suits your needs.